Solana Faces Sharp Decline Amid Broader Market Sell-Off

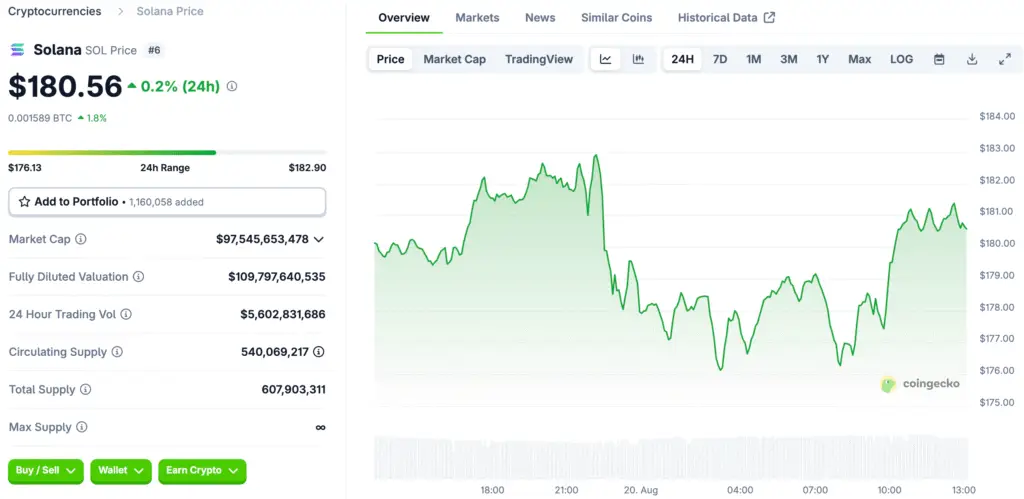

The cryptocurrency market entered a period of turbulence on August 19, 2025, as Bitcoin slipped below $115,000, triggering more than $450 million in liquidations. This wave of volatility spread across altcoins, dragging Solana down from a recent six-month high of $209.80 to levels 15.5% lower.

While some traders viewed this as the beginning of a bearish double-top pattern, others argue that Solana’s on-chain fundamentals remain intact, setting the stage for a potential rebound.

DEX Volumes Reinforce Solana’s Market Strength

One of Solana’s most compelling metrics is the performance of its decentralised exchange (DEX) ecosystem. In the past 30 days, Solana recorded $111.5 billion in DEX trading volumes, outpacing most competing networks and establishing itself as the second-largest platform after Ethereum.

This robust activity signals that traders continue to trust Solana’s infrastructure, even amid volatility. It also suggests that DeFi users are finding better efficiency and liquidity opportunities on Solana compared to Ethereum’s layer-2 solutions or rival blockchains like BNB Chain.

Total Value Locked on Solana Surges 20% in Two Months

Beyond trading volumes, Solana’s Total Value Locked (TVL) has climbed to $12.1 billion, marking a 20% increase in just two months. Several decentralised applications (DApps), such as Kamino, Jito, and Raydium, have surpassed $2 billion in TVL individually, reflecting rising user confidence in the ecosystem.

A higher TVL often signals sustainable network engagement, as more capital is deployed into lending, staking, and liquidity pools. This growth reinforces the demand for SOL tokens, which are used to pay fees and secure the network.

Fee Generation Highlights Solana’s Competitive Edge

Solana’s ability to generate network fees is another important indicator of health. Over the past 30 days, the blockchain generated $35.6 million in fees, representing a 22% increase from the previous month. In comparison, Ethereum collected $41.4 million but saw a 7% decline during the same period.

The contrasting trends highlight Solana’s momentum and its advantage as a low-cost, high-throughput platform that can handle surging demand without requiring complex layer-2 infrastructure. For many developers and users, this cost efficiency is a critical differentiator.

Institutional Investors Increase Exposure to Solana

Institutional demand for Solana continues to accelerate, signalling growing recognition of its long-term potential. Open interest in SOL futures surged to $10.7 billion, up from $6.9 billion just two months earlier, surpassing XRP futures despite XRP’s larger market capitalisation.

Moreover, Solana has attracted $2.8 billion in exchange-traded products (ETP) and futures exposure, indicating confidence from global investors. Analysts also highlight Solana’s 7.3% native staking yield as a powerful incentive for institutions once spot ETFs gain approval in the United States.

Analysts Predict a $200 Rebound for Solana

Despite recent volatility, many market analysts remain optimistic about Solana’s near-term price trajectory. The combination of high DEX volumes, growing TVL, increasing fee revenue, and institutional participation suggests that the market may have prematurely turned bearish.

Several analysts forecast that Solana could soon retest the $200 level, particularly if broader market conditions stabilise and ETF approval probabilities currently estimated at over 90% translate into actual regulatory milestones.

Why Solana’s Fundamentals Point to Long-Term Growth

The retracement from $209.80 has raised short-term concerns, but Solana’s strong fundamentals indicate that the network is positioned for sustained expansion. Unlike speculative meme tokens or weaker altcoin projects, Solana has demonstrated consistent growth in adoption, scalability, and developer activity.

Its ability to attract institutional interest, maintain high levels of DeFi engagement, and sustain competitive yields all suggest that the token’s decline is temporary. If current trends persist, Solana could solidify its role as a long-term leader in decentralised finance and blockchain infrastructure.

Read More: Solana Network Breakthrough: Unpacking the 100K TPS Milestone